What is the salary for a Bristow helicopter pilot? While exact figures are confidential, U.S.-based Bristow pilots in offshore, charter, and EMS roles can typically earn between $90,000 and $180,000+ annually, with senior offshore captains reaching the higher end. This comprehensive breakdown goes beyond the base salary to explain how contract cycles, market forces, and a recent industry-wide pay deal shape total compensation at one of the world’s leading vertical lift operators.

The analysis shows how candidates and current employees can benchmark earnings by role, contract type, and base assignment. Key drivers include mission risk, scheduling intensity, and specialized certifications—factors that differentiate an offshore captain’s pay from a charter or EMS pilot’s salary.

For a complete overview of earnings across the aviation industry, see our detailed Helicopter Pilot Salary Guide, which covers pay by role, employer, and career stage. You can also explore the highest-paying helicopter pilot jobs and salary expectations at every career stage.

Key Takeaways

- Scope covers offshore transport, charter missions, and EMS pay structures for the U.S. market.

- Benchmarks help candidates and employees assess pay by role, contract, and base.

- Data combines reported negotiations, contracts, and company policies—no unsupported claims.

- Certifications, mission risk, and schedule intensity are primary drivers of compensation.

- Leadership, management focus, and fair employment standards influence long-term pay trends.

Bristow Helicopters Salary: Key Figures at a Glance

Wondering about the numbers? A Bristow helicopter pilot’s salary varies significantly by role, experience, and location. For U.S.-based pilots, here is a general overview of what you can expect:

| Role & Experience Level | Estimated Annual Salary Range (U.S.) | Primary Compensation Drivers |

|---|---|---|

| Offshore / Oil Rig Transport Captain *(Senior, 5+ years experience)* |

$120,000 – $180,000+ | Contract cycles, flight hours, mission risk, and specialized certifications (e.g., instrument overwater). High utilization on long-term energy contracts drives top earnings. |

| Charter Captain *(Mid-level, 3+ years experience)* |

$90,000 – $140,000 | Client mix (energy, corporate, tourism), seasonal demand, and aircraft utilization. Premiums are paid for specialized missions or high-demand periods. |

| EMS / Medevac Pilot (With turbine & IFR experience) |

$100,000 – $150,000 | 24/7 readiness requirements, mission complexity, and advanced certifications (NVG, instrument currency). Rotary-wing EMS typically commands a premium over fixed-wing. |

| First Officer / Entry-Level Pilot (Following training) |

$70,000 – $90,000 | Initial placement, base location, and the specific sector (Offshore, EMS, Charter). Salary grows rapidly with accumulated flight hours and type ratings. |

Key Takeaway: The recent multi-year pay deal, which included an ~11% base uplift, has positively shifted these ranges. The figures above are estimates; actual compensation includes base pay, flight-hour bonuses, per diems, and benefits, which can add 15-30% to total remuneration.

Industry Overview And Market Forces Shaping Bristow Pilot Salaries

Demand from offshore oil-and-gas transport and government search-and-rescue contracts is the primary engine driving pay bands at Bristow. Commodity prices and public funding cycles create predictable peaks and troughs that directly impact hiring, flight hours, and annual compensation for pilots.

Present Market Context: Oil & Gas, Search and Rescue, and U.S. Operations

Long-term offshore energy contracts and emergency service agreements provide the revenue stability that allows Bristow to plan for competitive salaries. This visibility ensures the company can retain pilots and have staff ready during high-demand windows, which is reflected in the premiums paid for offshore and EMS roles shown in the salary table above.

The Impact of the Multi-Year Pay Deal

A significant round of industrial action in 2023-2024 led to a new multi-year agreement, signaling strong collective bargaining power. This deal included a roughly 11% base salary uplift plus a one-off 6% payment, effectively resetting compensation baselines. For pilots, this means recent hires and those negotiating new terms are seeing salaries at the higher end of historical ranges.

How EEO Standards Influence Pay and Advancement

Bristow’s formal Equal Employment Opportunity (EEO) commitment provides a framework for standardized recruitment and promotion. Clear policies help ensure pay equity across roles and experience levels, which reduces turnover risk and supports the consistent compensation structure outlined in this report.

For current offshore pilot openings and requirements, visit the official Bristow Group careers page.

Bristow Helicopter Pilot Salary: Offshore, Oil Rig Transport, And Charter Roles

What is the salary for a Bristow offshore pilot? Compensation for these high-demand roles is primarily driven by three factors: the value of long-term energy contracts, aircraft utilization (flight hours), and the specialized technical skills required for overwater operations. These elements determine base pay, flight-duty allowances, overtime structures, and annual bonuses.

Offshore and Oil Rig Transport Pilot Earnings: Key Drivers

For offshore pilots, salary is closely tied to the boom-and-bycle cycle of the energy sector. New contract awards with major oil and gas clients often trigger wage reviews, meaning pilots can see significant pay adjustments when flight hours and operational risk increase.

Industry Insight: Recent negotiations led to a major multi-year pay deal, reported to include an 11% base salary increase plus a one-off 6% payment. This sets a new benchmark for offshore and charter pay scales.

Beyond the base rate, total compensation is boosted by premiums for:

-

Advanced Certifications: Type ratings for medium/heavy aircraft (like the Sikorsky S-92) and Instrument Flight Rules (IFR) proficiency over water.

-

Mission Risk Pay: Standby duty, weather contingencies, and long overwater segments are factored into pay to reflect the inherent risks.

-

Client Requirements: Pilots who pass stringent client safety audits often qualify for additional allowances.

How does Bristow charter pilot pay compare?

While sharing similar drivers with offshore roles, charter pilot salaries at Bristow are more directly influenced by the client mix (corporate, tourism, utility) and seasonal demand. High utilization during peak seasons on specialized missions typically commands the strongest compensation packages.

Benchmarking Your Offer

When evaluating a Bristow offer, candidates should compare it to industry standards. For context, you can review salary data from other major operators:

-

Air Methods Helicopter Pilot Salary (Leading EMS Provider)

-

US Coast Guard Helicopter Pilot Salary (Military/Public Service Benchmark)

For official licensing requirements relevant to these roles, pilots should always consult the FAA’s pilot certification guide.

Charter Helicopter Pilot Salary: Client Mix, Utilization, And Seasonal Demand

A Bristow charter pilot’s salary is more variable than an offshore pilot’s, primarily shaped by the client mix—flying for energy, corporate, tourism, or utility sectors—and seasonal demand peaks.

What drives a charter pilot’s pay at Bristow?

-

Revenue per Flight Hour: Missions with higher billing rates, like specialized corporate transport or urgent utility work, directly translate to stronger compensation packages.

-

On-Demand Availability: Pilots who are flexible for short-notice, high-priority charters often qualify for premium pay and bonuses.

-

Seasonal Utilization: Monthly income can fluctuate significantly. High season (e.g., summer tourism, winter utility inspections) means more flight hours and higher earnings.

Beyond the Base Salary:

When evaluating a charter role, pilots should look at the total package:

-

Career Progression: Bristow’s retention programs often include clear pathways to captaincy and training for higher-responsibility positions.

-

True Cost & Benefits: Weigh the base salary against duty schedules, per diem rates, travel logistics, and the cost of maintaining necessary type ratings.

-

Sector Premium: Rotary-wing charter roles typically command higher earnings than fixed-wing charter counterparts, reflecting the greater complexity of helicopter missions.

For a broader perspective on where charter pilot pay fits within the industry’s top tiers, see our analysis of the highest-paying helicopter pilot jobs.

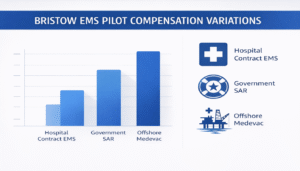

EMS Pilot Compensation and Sector Variations at Bristow

For EMS (Emergency Medical Service) pilots at Bristow, compensation is fundamentally tied to 24/7 readiness, high-stakes mission complexity, and the non-negotiable demands of rapid medical dispatch. This results in a distinct pay structure that often includes premiums not found in other flight operations.

Why Do EMS Pilots Earn a Premium?

Rotary-wing EMS roles command higher salaries than many fixed-wing counterparts due to three critical factors:

-

Critical Access & Speed: Helicopters provide direct access to accident scenes and hospital rooftops, drastically reducing patient transfer time. This lifesaving capability is financially valued.

-

Advanced Skill Requirements: EMS pilots must maintain peak proficiency in Night Vision Goggle (NVG) operations, instrument flying in low visibility, and close coordination with medical crews.

-

Operational Intensity: The “on-call” nature and pressure of emergency response are compensated through readiness allowances and differential pay for off-hours flights.

Bristow EMS Salary Context

While Bristow does not publicize exact figures, U.S. EMS helicopter pilot salaries typically range between $90,000 and $150,000+ for experienced pilots, with Bristow’s scale expected to be competitive within this band, influenced by the recent industry pay deal.

Global Benchmark Insight: Reporting from international operations, such as Nigeria where rotary-wing EMS crews earn approximately $155,550 annually, supports the universal principle that these specialized vertical-lift roles attract a significant pay premium.

Comparing EMS to Other Bristow Roles

Prospective hires should evaluate the total package. While offshore pilot pay may peak higher due to contract bonuses, EMS roles offer a unique mix of mission-driven work and structured pay premiums. Similarly, those considering a helicopter flight instructor career path for building hours will find EMS offers a substantial increase in earning potential.

Making an Informed Career Decision

When evaluating a Bristow EMS offer, look beyond base pay:

-

Benefits & Training: Does the company offer strong medical benefits and reimbursement for recurrent NVG or safety training?

-

Schedule & Lifestyle: Understand the rotation (e.g., 7 days on/7 days off) and how it aligns with your life.

-

Career Path: Clarify the progression from co-pilot to pilot-in-command and any pathways into management.

| Role Type | Primary Drivers | Typical Premiums | Implication For Employees |

|---|---|---|---|

| Rotary‑Wing EMS | Rapid access, NVG, clinical crew | Higher base + readiness allowances | Higher total pay; more training required |

| Fixed‑Wing EMS | Long range, runway access, fewer landings | Lower base; fewer urgency differentials | Stable schedules; lower proficiency load |

| Off‑Base Contractors | Contract terms, insurer requirements | Varies by operator and client | Compare benefits, training, and leadership support |

For a detailed breakdown of pay in the lifesaving sector, explore our dedicated guide to EMS & Medevac Helicopter Pilot Salaries.

Maximizing Your Bristow Helicopter Pilot Salary

The bottom line for any pilot considering Bristow is this: your earnings will be a direct reflection of your role, the contracts you support, and the specialized skills you bring to the aircraft.

-

For Offshore Pilots, your pay is dictated by high-value energy contracts and utilization.

-

For Charter Pilots, client mix and seasonal demand are your key drivers.

-

For EMS Pilots, mission-critical readiness and advanced certifications command a premium.

The recent multi‑year pay deal—with its 11% base uplift and one‑off 6% payment—signals strong, durable momentum in compensation. This is a positive trend that current and prospective employees should factor into their long-term career planning at Bristow.

Your Action Plan: Beyond the Bristow Salary

Understanding one company’s pay structure is just the first step. To truly maximize your earning potential in the aviation industry, you need a broader strategy:

-

Benchmark Your Offer: How does a Bristow salary compare to the industry’s top tiers? Research the highest-paying helicopter pilot jobs to see where your target role stands.

-

Plan Your Career Path: Your salary evolves with your experience. Use our comprehensive Helicopter Pilot Salary Guide to map out expected earnings from your first job through to a senior captaincy, across all major employers and sectors.

-

Evaluate the Total Package: Always weigh salary against benefits, training opportunities, work-life balance, and company culture. The best financial decision is one that supports a sustainable and rewarding career.

Whether you’re aiming for the offshore rigs, the cockpit of an air ambulance, or the left seat of a corporate charter, informed decisions are the most powerful ones. Use the insights from this breakdown as your foundation.

Frequently Asked Questions About Bristow Helicopter Pilot Salary

What is the starting salary for a pilot at Bristow Helicopters?

For newly hired First Officers or pilots in their first U.S. assignment with Bristow, starting salaries typically range from $70,000 to $90,000 per year. This varies by assigned sector (offshore support often starts higher), base location, and the pilot’s existing qualifications. Total compensation includes benefits and potential bonuses, with significant growth expected as flight hours and experience accumulate.

What is the salary range for Bristow offshore and charter pilots?

Offshore pilots at Bristow can expect salaries ranging from $120,000 to $180,000+, largely driven by energy contract values and flight hours. Bristow charter pilot salaries are more variable, generally between $90,000 and $140,000, depending on client mix (corporate, tourism) and seasonal demand. Total remuneration includes base pay, per diem, and flight-hour bonuses.

How do oil prices impact Bristow pilot salaries?

Oil prices directly affect demand for offshore transport. Strong oil markets increase flight hours and crew demand for Bristow’s energy sector, pushing wages upward. Conversely, downturns can reduce offshore operations and suppress hiring or bonus pools in the short term.

How did the recent Bristow pilot pay deal affect salaries?

The multi-year deal following 2024 industrial action included an ~11% base salary increase and a one-off 6% payment. This deal reset pay benchmarks across offshore, charter, and EMS roles, providing durable upward momentum for pilot compensation at Bristow.

What benefits package do Bristow pilots receive?

Beyond base salary, Bristow pilot compensation typically includes health insurance, retirement plans (like a 401k), flight-hour bonuses, per diems, training allowances, and life insurance. A comprehensive benefits package is a critical part of total remuneration and career security.

What determines an offshore pilot’s salary at Bristow?

Key drivers are:

1. Contract cycles with major energy clients,

2. Specialized certifications (instrument overwater, hoist operations)

3. Flight hour utilization

4. Risk premiums for standby duty and long overwater segments.

Rotational schedules and remote base allowances also boost take-home pay.

What determines charter pilots’ compensation over a year?

Annual income for a Bristow charter pilot depends on utilization rate (flight hours), client mix (energy vs. tourism), and seasonality. Pilots flying high-demand corporate or specialized utility charters earn premium rates. Operators may offer hourly rates plus retainers for recurring clients.

How does EMS pay at Bristow compare to other pilot roles?

Bristow EMS pilot pay is competitive, often commanding a premium over fixed-wing medical transport due to the critical nature of helicopter emergency services. Higher compensation reflects the 24/7 readiness, advanced skills (NVG, instrument currency), and mission complexity required.

How does base location affect a Bristow pilot’s pay?

Pay varies by region due to cost of living, operational demand, and contract availability. U.S. bases in active energy regions (e.g., Gulf Coast) or major metro areas with strong EMS contracts typically offer higher base salaries and premiums compared to lower-cost regions.

What should candidates evaluate when comparing a Bristow job offer?

Candidates should review:

1. Total compensation (base + bonuses + benefits)

2. Expected flight hours and schedule

3. Training and advancement pathways

4. Safety culture and operational history

5. Contract stability in your assigned sector (offshore, EMS, charter).